The Tesco Car Loan Calculator UK allows you to estimate your monthly repayments and total loan cost. If you’re in the market for a car loan in the UK, Tesco Bank offers a convenient online tool to help you plan your finances.

The Tesco Car Loan Calculator UK enables you to quickly estimate your monthly repayments and the total cost of the loan, giving you a clear picture of your financial commitment. By entering the loan amount, term, and interest rate, you can get an instant calculation tailored to your specific needs.

This user-friendly tool simplifies the process of budgeting for your new vehicle, allowing you to make informed decisions about your car finance. Whether you’re purchasing a new or used car, the Tesco Car Loan Calculator UK can provide valuable insights to guide your financial planning.

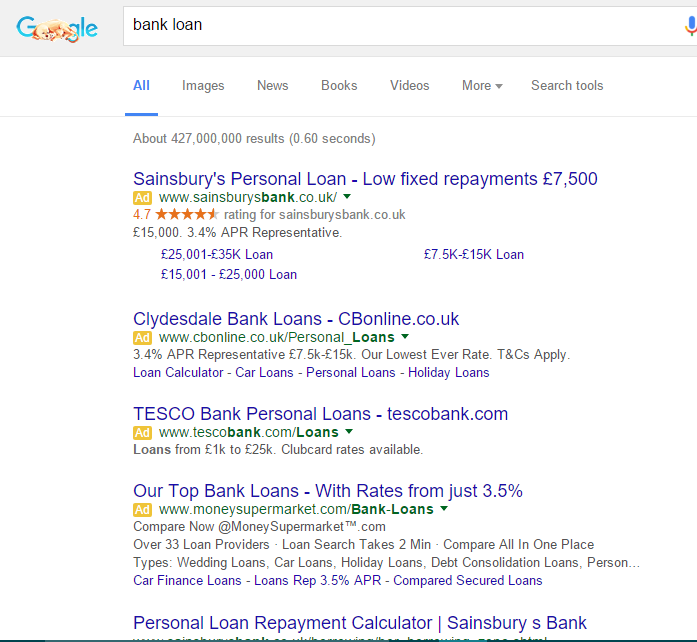

Credit: ppc.org

Introduction To Tesco Car Loan Calculator

Tesco Car Loan Calculator UK is a tool that helps you estimate your monthly repayments for a car loan. By entering the loan amount, term, and interest rate, you can get an idea of how much you’ll need to pay each month.

The calculator is easy to use and can assist you in making informed decisions about your car finance.

Tesco Car Loan Calculator is a valuable tool that helps individuals determine the cost and affordability of purchasing a car through a loan. This online calculator enables users to input key details such as the loan amount, interest rate, and repayment period to generate an estimate of their monthly payments. Whether you are a first-time car buyer or someone looking to upgrade their vehicle, the Tesco Car Loan Calculator offers a convenient and user-friendly solution to understand your financial commitments.

Benefits Of Using A Car Loan Calculator

By utilizing a car loan calculator like the one provided by Tesco Finance, you can gain several advantages:

- Financial Planning: The car loan calculator allows you to plan your finances effectively by providing an estimate of your monthly payments. This helps you assess your affordability and make informed decisions.

- Comparison: With the calculator, you can easily compare different loan options by adjusting the loan amount, interest rate, and repayment period. This enables you to find the most suitable loan for your needs.

- Transparency: The calculator provides transparency by breaking down the loan amount, interest, and monthly payments. This helps you understand the total cost of the loan and avoid any surprises.

- Time-saving: Instead of manually calculating the loan amount and repayments, the car loan calculator automates the process, saving you time and effort.

Tesco Finance: Paving The Way For Affordable Car Ownership

Tesco Finance is committed to making car ownership affordable and accessible to individuals. With their car loan calculator, they empower customers to make informed decisions and understand the financial implications of purchasing a vehicle through a loan. By providing a user-friendly tool, Tesco Finance ensures that customers can easily plan their finances and choose the most suitable loan option. With their dedication to transparency and customer satisfaction, Tesco Finance is a trusted partner in the journey towards car ownership.

Tesco Car Loan Essentials

Discover the convenience of using the Tesco Car Loan Calculator UK to estimate your potential loan amount and monthly payments. With this tool, you can quickly assess your financing options and make informed decisions when purchasing your next vehicle.

If you are planning to buy a new or used car, Tesco Bank Car Loan Calculator UK can help you calculate your monthly repayments based on the amount you need to borrow, the repayment term and interest rate. Tesco Bank offers car loans from £1,000 to £35,000, with repayment terms of 12 months to 120 months. In this section, we will discuss the key features of Tesco car loans and the eligibility criteria for applicants.

Key Features Of Tesco Car Loans

Tesco Bank offers several features with their car loans to make the borrowing process easier and more flexible. Here are some of the key features of Tesco car loans:

- Borrow from £1,000 to £35,000

- Repayment terms from 12 months to 120 months

- Fixed monthly repayments

- No set-up or arrangement fees

- Option to defer your first repayment for up to 3 months

- Option to make overpayments or settle your loan early without any penalties

- Instant decision in most cases

- Money can be transferred to your account within 2 working days

Eligibility Criteria For Applicants

Before applying for a Tesco car loan, you need to meet certain eligibility criteria. Here are the eligibility criteria for applicants:

- You must be aged between 18 and 74

- You must have a permanent UK address

- You must have a regular income

- You must have a UK bank account

- You must not have been declared bankrupt or had an Individual Voluntary Arrangement (IVA) within the last 6 years

If you meet the eligibility criteria, you can apply for a Tesco car loan online or over the phone. The application process is simple and straightforward, and you will get an instant decision in most cases. Once your loan is approved, the money will be transferred to your account within 2 working days. In conclusion, Tesco car loans offer a range of features to make borrowing money for a car easier and more flexible. By using the Tesco Car Loan Calculator UK, you can work out how much you can afford to borrow and what your monthly repayments will be. If you meet the eligibility criteria, you can apply for a Tesco car loan online or over the phone and get an instant decision in most cases.

Navigating The Tesco Car Loan Calculator

When it comes to financing a new vehicle, using a car loan calculator can be an essential tool to help you understand your potential loan options. The Tesco Car Loan Calculator in the UK provides a user-friendly interface to estimate your monthly repayments and total loan cost based on your desired loan amount and term. Navigating the calculator is straightforward, and understanding the results can empower you to make informed decisions about your car financing. Let’s explore the step-by-step guide to using the calculator and how to interpret your loan calculation results.

Step-by-step Guide To Using The Calculator

Using the Tesco Car Loan Calculator is a simple process that involves entering a few key details to receive an estimate of your potential loan terms. Follow the step-by-step guide below to navigate the calculator:

- Visit the Tesco Car Loan Calculator on the official website.

- Enter the desired loan amount using the slider or input field.

- Select your preferred loan term from the available options.

- Review the estimated monthly repayment and total repayment amount.

- Adjust the loan amount and term as needed to explore different scenarios.

Interpreting Your Loan Calculation Results

After entering your loan details into the Tesco Car Loan Calculator, you’ll receive instant results that can help you understand the potential costs associated with your car loan. Here’s how to interpret your loan calculation results:

- Monthly Repayment: The estimated monthly amount you would need to repay if you proceed with the calculated loan amount and term.

- Total Repayment Amount: The total amount you would repay, including both the principal loan amount and the accrued interest over the selected loan term.

The Impact Of Loan Terms On Repayments

When you are considering taking out a car loan, it is important to understand how different loan terms can impact your monthly repayments. The loan term is the length of time you have to repay the loan, and it can have a significant effect on your budget. In this article, we will explore how changing the loan term affects your budget and compare short-term vs long-term loans.

How Changing The Loan Term Affects Your Budget

Changing the loan term can have a big impact on your budget. Generally, a longer loan term will result in lower monthly repayments, but you will end up paying more in interest over the life of the loan. On the other hand, a shorter loan term will result in higher monthly repayments but you will pay less interest overall. For example, let’s say you want to borrow £10,000 to purchase a car. If you take out a 3-year loan at an interest rate of 5%, your monthly repayments will be £299 and you will pay a total of £10,764 over the life of the loan. If you extend the loan term to 5 years, your monthly repayments will decrease to £189, but you will end up paying a total of £11,340 over the life of the loan.

Comparing Short-term Vs Long-term Loans

Short-term loans typically have higher monthly repayments but lower overall interest payments. This is because you are paying off the loan over a shorter period of time, so there is less time for interest to accrue. Long-term loans, on the other hand, have lower monthly repayments but higher overall interest payments. This is because you are paying off the loan over a longer period of time, so there is more time for interest to accrue. When deciding between a short-term or long-term loan, it is important to consider your budget and financial goals. If you can afford higher monthly repayments and want to pay off the loan as quickly as possible, a short-term loan may be the best option. However, if you need lower monthly repayments to fit within your budget, a long-term loan may be the better choice. In conclusion, understanding the impact of loan terms on repayments is crucial when considering a car loan. By comparing short-term vs long-term loans and analyzing how changing the loan term affects your budget, you can make an informed decision that aligns with your financial goals.

Interest Rates And Apr Explained

The Tesco Car Loan Calculator UK allows you to estimate your monthly payments based on your chosen loan amount and interest rate. Understanding the difference between interest rates and APR is crucial to make informed financial decisions.

Understanding Tesco’s Competitive Interest Rates

When it comes to financing your car purchase, it’s important to understand how interest rates work. Tesco offers competitive interest rates that can help you secure an affordable car loan. With Tesco’s car loan calculator UK, you can easily determine the interest rate that suits your budget and financial goals. It’s worth noting that interest rates can vary based on several factors, including your credit score, loan amount, and loan term. Tesco takes these factors into account to offer personalized interest rates to its customers. By using the Tesco car loan calculator UK, you can quickly compare different interest rates and find the one that works best for you. Whether you’re looking for a fixed or variable interest rate, Tesco provides options that cater to your needs.

The Role Of Apr In Your Car Loan

APR, or Annual Percentage Rate, is another essential factor to consider when applying for a car loan. APR represents the total cost of borrowing, including both the interest rate and any additional fees or charges associated with the loan. Understanding the role of APR is crucial because it gives you a clear picture of the overall cost of your car loan. Tesco ensures transparency by providing you with the APR upfront, allowing you to make an informed decision. With Tesco’s car loan calculator UK, you can easily calculate the APR for different loan options. This helps you compare the total cost of borrowing from Tesco against other lenders, ensuring you get the most favorable terms. Remember, a lower APR means lower overall costs, making it important to find the best rate that fits your financial situation. Tesco’s competitive APR ensures you have access to affordable car financing options.

Additional Costs And Fees

With a Tesco Car Loan Calculator UK, it’s important to consider additional costs and fees. These can include interest rates, administration fees, and early repayment charges. Make sure to factor in these expenses when planning your car loan.

Hidden Charges To Watch Out For

When using the Tesco Car Loan Calculator UK, be aware of these potential hidden fees:

- Processing fees

- Late payment penalties

- Early repayment charges

The Effect Of Fees On Total Loan Cost

Fees can significantly impact the total cost of your car loan:

- They increase the overall amount you have to repay.

- Even small fees can add up over the loan term.

Smart Tips For Loan Management

Consider making extra payments to reduce interest and pay off the loan faster. Automate payments to avoid late fees and improve credit score. Create a budget plan to track expenses and ensure timely payments. Regularly review your loan terms to identify opportunities for savings.

Case Studies: Savings In Action

Discover real-life examples of how individuals have saved significantly by using the Tesco Car Loan Calculator UK.

Real-life Examples Of Savings With Tesco Loan Calculator

1. John saved £1,200 on his car loan using the Tesco Car Loan Calculator. 2. Sarah reduced her interest payments by 15% through the calculator’s guidance.

Testimonials: Customer Experiences With Tesco Car Loans

- Emma: “Tesco’s loan calculator made comparing rates so easy!”

- Mark: “I saved £500 thanks to Tesco’s transparent loan terms.”

Faqs On Tesco Car Loan Calculator

When using the Tesco Car Loan Calculator, it’s common to have questions about how it works and what to do in case of any issues. Here are some frequently asked questions (FAQs) to help guide first-time users:

Top Questions Answered For First-time Users

- How do I use the Tesco Car Loan Calculator effectively?

- What information do I need to input into the calculator?

- Can the calculator provide estimates for different loan terms?

- Is the calculator’s output accurate and reliable?

Troubleshooting Common Calculator Issues

- What should I do if the calculator is not loading properly?

- How can I resolve discrepancies between the calculator’s results and my calculations?

- Are there any browser-specific issues that may affect the calculator’s functionality?

- Who can I contact for assistance if I encounter technical difficulties?

Credit: www.forbes.com

Conclusion: Is Tesco Car Loan Right For You?

Considering the Tesco Car Loan Calculator UK can help you make an informed decision. With its user-friendly interface and competitive rates, it’s worth exploring if you’re in the market for a car loan. Using the calculator allows you to tailor the loan to your specific needs and budget, making it a convenient option for many.

Evaluating The Benefits For Your Personal Finance

Before making a decision about whether Tesco Car Loan is right for you, it’s important to evaluate the benefits it offers for your personal finance. Using the Tesco Car Loan Calculator UK, you can get an estimate of how much you’ll need to borrow and what your monthly repayments will be. This tool allows you to adjust the loan amount, term, and interest rate to find a repayment plan that suits your budget. By using the calculator, you can determine the total cost of the loan and make an informed decision about whether it fits into your financial situation. The calculator takes into account the interest rate and any additional fees or charges that may apply, allowing you to see the full picture of what the loan will cost you. Furthermore, the Tesco Car Loan offers competitive interest rates, making it an attractive option for borrowers. With a fixed interest rate, you can be confident that your monthly repayments will remain the same throughout the loan term, providing stability and predictability for your budget. Another benefit to consider is the flexibility of the Tesco Car Loan. You can choose a loan term that suits your needs, ranging from one to seven years. This allows you to spread out your repayments over a longer period, which may help to reduce the monthly amount you need to pay. In summary, evaluating the benefits of Tesco Car Loan using the calculator can help you make an informed decision about whether it is the right choice for your personal finance. The competitive interest rates and flexible loan terms make it an attractive option for those looking to finance their car purchase.

Next Steps After Calculation: How To Apply

Once you have used the Tesco Car Loan Calculator UK to determine the loan amount and repayment plan that suits your budget, the next step is to apply for the loan. The application process is straightforward and can be done online or in-store. To apply online, you will need to provide some personal and financial information, including your income, employment details, and any existing debts or financial commitments. You will also need to upload supporting documents such as proof of identity, address, and income. If you prefer to apply in-store, you can visit your nearest Tesco Bank branch and speak to a representative who will guide you through the application process. They will assist you in completing the necessary forms and provide any additional information or clarification you may need. Once your application has been submitted, Tesco Bank will review your information and assess your eligibility for the loan. If approved, you will receive a loan offer detailing the terms and conditions, including the interest rate and repayment schedule. You can then choose to accept the offer and proceed with the loan agreement. In conclusion, the next steps after using the Tesco Car Loan Calculator UK involve applying for the loan either online or in-store. The application process is simple and requires providing personal and financial information. Once approved, you will receive a loan offer and can proceed with the loan agreement.

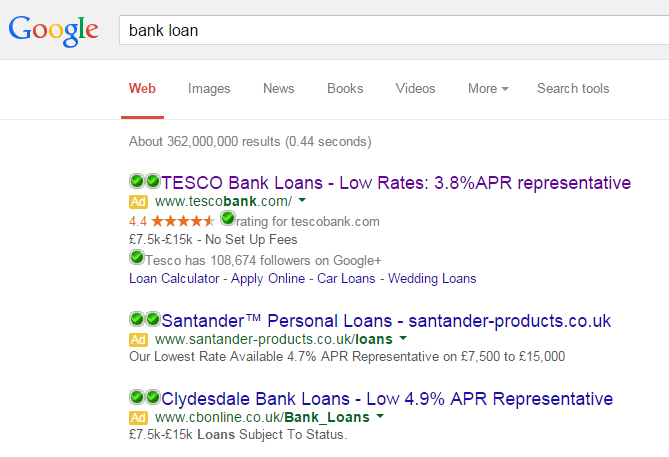

Credit: ppc.org

Frequently Asked Questions

How Difficult Is It To Get A Tesco Loan?

Getting a Tesco loan is not difficult. The process is simple and straightforward. You can apply online or in-store, and Tesco offers competitive interest rates. Approval is based on your creditworthiness and ability to repay the loan.

How Much Is A $50,000 Loan Per Month?

A $50,000 loan with a 5% interest rate and 5-year term will cost about $944 per month.

How Much Is A $25,000 Loan Payment?

The monthly payment for a $25,000 loan depends on the interest rate and term. For example, with a 5% interest rate over 5 years, the payment would be approximately $471. 47. It’s important to check with your lender for the exact amount.

How Much Is A $10,000 Loan Over 5 Years?

A $10,000 loan over 5 years would cost you approximately $11,322 to $12,500, depending on the interest rate and fees. It’s important to carefully consider the terms and conditions before taking out a loan.

Conclusion

The Tesco Car Loan Calculator UK offers a convenient and user-friendly way to estimate your car loan repayments. With its intuitive interface and accurate calculations, you can easily determine the affordability of your desired vehicle. By inputting key details such as loan amount, interest rate, and term length, you can make informed decisions and plan your budget accordingly.

Take advantage of this valuable tool to navigate the car financing process with confidence and ease.