Introduction To Car Loan Calculators

Car loan calculators are helpful tools that allow you to estimate your monthly car payments based on factors such as the loan amount, interest rate, and repayment term. Using a car loan calculator UK can help you determine how much you can afford to borrow and what your monthly payments will be.The Role Of Car Loan Calculators

Car loan calculators play a vital role in helping UK car buyers make informed decisions about their vehicle financing options. These nifty online tools are designed to provide users with accurate estimates of loan repayment amounts, interest rates, and overall costs. By simply entering a few details such as the loan amount, interest rate, and loan term, car loan calculators can quickly generate valuable insights into the affordability of different car loan options. Let’s explore the role of car loan calculators in more detail.Advantages For Uk Car Buyers

Using a car loan calculator offers several advantages for car buyers in the UK. Here are some key benefits:- Financial Planning: Car loan calculators allow buyers to plan their finances effectively by providing clear visibility into monthly repayment amounts. This helps individuals determine whether they can comfortably afford the loan without straining their budget.

- Comparing Loan Options: By inputting different loan amounts and interest rates into the calculator, buyers can easily compare various loan options side by side. This empowers them to choose the most affordable and suitable option for their needs.

- Budgeting: Car loan calculators help buyers establish a realistic budget by factoring in additional costs such as insurance, taxes, and maintenance. This ensures that the overall cost of car ownership is considered, allowing buyers to make a well-informed decision.

- Time-Saving: Instead of manually calculating loan repayments using complex formulas, car loan calculators provide instant results, saving buyers valuable time and effort. This allows them to focus on finding the right car within their budget.

Key Features Of Car Loan Calculators

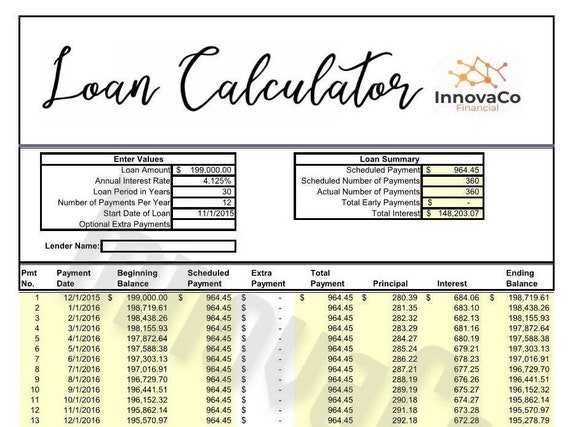

Discover the essential features of car loan calculators in the UK. Easily estimate monthly payments, interest rates, and loan terms for your next vehicle purchase. Compare options and make informed decisions using a car loan calculator. Car loan calculators are an essential tool for anyone who is looking to purchase a car. They provide insight into the monthly payments, interest rates, and other details of the loan. Here are the key features of car loan calculators:Interest Rate Input

The interest rate input is one of the most important features of a car loan calculator. It allows users to input the interest rate that they have been quoted by their lender. This helps users to understand how much they will be paying in interest over the life of the loan. It also helps users to compare different loan options and choose the one that is best for them.Amortization Schedule Insights

The amortization schedule is another important feature of a car loan calculator. It provides users with a breakdown of how their monthly payments will be applied to the principal and interest of the loan. This helps users to understand how much of their payment is going towards paying down the loan and how much is going towards interest. It also helps users to understand how long it will take to pay off the loan.Payment And Loan Term Calculation

Car loan calculators help users to calculate their monthly payment and loan term. Users can input the amount of the loan, the interest rate, and the loan term to get an estimate of their monthly payment. This helps users to understand how much they will need to budget for their car payment each month. It also helps users to choose a loan term that is best for them.Comparison Of Loan Options

Car loan calculators allow users to compare different loan options. Users can input the details of different loans to see how they compare in terms of monthly payment, interest rate, and loan term. This helps users to choose the loan that is best for them.Summary Table

The summary table is a helpful feature of car loan calculators. It provides users with a summary of the loan details, including the monthly payment, interest rate, and loan term. This makes it easy for users to compare different loan options and choose the one that is best for them. Overall, car loan calculators are an essential tool for anyone who is looking to purchase a car. They provide insight into the monthly payments, interest rates, and other details of the loan. By using a car loan calculator, users can make an informed decision about their car loan and choose the option that is best for them.How To Use A Car Loan Calculator Effectively

When considering a car loan, it’s crucial to make informed financial decisions. Utilizing a car loan calculator can provide invaluable insights into your potential monthly payments and overall loan costs. To maximize the benefits of this tool, it’s essential to understand how to use a car loan calculator effectively.Entering Accurate Information

Accuracy is key when using a car loan calculator. Begin by entering the purchase price of the vehicle, followed by your desired loan term and interest rate. Be sure to input the down payment amount and any trade-in value to obtain the most precise estimation of your monthly payments.Adjusting Variables For Different Scenarios

Flexibility is vital when utilizing a car loan calculator. Experiment with various scenarios by adjusting the loan term and interest rate to observe their impact on your monthly payments. This allows you to make informed decisions based on different financial scenarios.Understanding Interest Rates In The Uk

Understanding interest rates in the UK is crucial when it comes to taking out a car loan. By using a car loan calculator UK, you can determine your monthly payments based on the interest rate and loan amount. This can help you make informed decisions about your finances and ensure you get the best deal possible. When you’re looking to buy a car in the UK, a car loan can be a great way to finance your purchase. However, before you apply for a car loan, it’s essential to understand how interest rates work in the UK. In this section, we’ll explore the different types of interest rates you may encounter and how they can impact your monthly payments.Types Of Interest Rates

There are two main types of interest rates you’ll come across when applying for a car loan in the UK: fixed and variable. A fixed interest rate means that your interest rate will remain the same throughout the term of your loan. This type of interest rate can be helpful as it allows you to budget accurately as your monthly payments will remain the same. On the other hand, a variable interest rate means that your interest rate can fluctuate throughout the term of your loan. This type of interest rate can be riskier as your monthly payments could increase or decrease.Impact On Monthly Payments

The interest rate you’re offered will have a significant impact on your monthly payments. Generally, the higher the interest rate, the higher your monthly payments will be. For example, if you borrow £10,000 over three years at an interest rate of 5%, your monthly payments will be £299.71. However, if you borrow the same amount over the same term at an interest rate of 7%, your monthly payments will increase to £308.44. It’s essential to shop around for the best interest rate when applying for a car loan, as even small differences in interest rates can add up over time and significantly impact your monthly payments. In conclusion, understanding interest rates is crucial when applying for a car loan in the UK. Be sure to explore your options and shop around for the best interest rate to ensure you get the best deal possible.Decoding The Fine Print Of Loan Terms

Deciphering the intricate details of loan terms is essential when utilizing a car loan calculator in the UK. Understand the fine print to make informed decisions and ensure a smooth borrowing experience.Total Loan Cost

Understanding the total loan cost is crucial when considering a car loan. It involves more than just the principal amount borrowed. The total loan cost includes the interest charges and any additional fees associated with the loan. Here’s a breakdown of what you need to know:- Principal Amount: This is the initial amount you borrow from the lender to purchase your car.

- Interest Rate: The interest rate is the percentage charged by the lender for borrowing the money. It determines the additional amount you have to repay on top of the principal.

- Loan Term: The loan term is the duration over which you will repay the loan. It can vary from a few months to several years.

- Total Interest Paid: This is the sum of all the interest payments made over the course of the loan term. It can significantly impact the overall cost of the loan.

- Additional Fees: Some lenders may charge additional fees, such as origination fees or processing fees. These fees should be considered when calculating the total loan cost.

Early Repayment Penalties

When opting for a car loan, it’s essential to be aware of any early repayment penalties that may apply. Early repayment penalties are fees charged by lenders if you decide to pay off your loan before the agreed-upon term. Here are a few key points to keep in mind:- Penalty Amount: The early repayment penalty amount varies depending on the lender and the terms of the loan. It’s usually a percentage of the remaining balance or a fixed fee.

- Restrictions: Some loans may have restrictions on early repayment, such as a minimum repayment period or a limit on the number of early repayments allowed per year.

- Considerations: Before deciding to pay off your loan early, it’s important to weigh the potential savings from interest against the cost of the early repayment penalty.

Tips For Negotiating Better Loan Terms

Looking to negotiate better loan terms for your car? Utilize a car loan calculator UK to determine your ideal terms. Compare offers from various lenders and leverage your credit score to secure a favorable interest rate. Additionally, consider making a larger down payment to reduce the overall loan amount.Researching Market Rates

Compare interest rates from various lenders to find the best deal.Improving Credit Score

Pay bills on time to boost credit score for better loan terms.The Impact Of Down Payments

The impact of down payments on car loans in the UK can be significant. By using a car loan calculator, borrowers can see how different down payment amounts affect their monthly payments and overall loan costs. It’s important to understand how down payments can save money and potentially shorten the loan term. The Impact of Down Payments Lowering Monthly Instalments Car Loan Calculator UK helps determine lower monthly payments. A larger down payment significantly reduces monthly instalments. Down payments affect monthly instalments directly. Reducing Total Interest Paid Down payments lead to reduced total interest paid. Higher down payments mean less interest over the loan term. Total interest paid decreases with substantial down payments.

Common Pitfalls To Avoid When Using Car Loan Calculators

When utilizing a car loan calculator, it’s vital to be wary of certain common pitfalls that can potentially lead to inaccurate estimations and financial missteps.Overlooking Additional Costs

Many borrowers make the mistake of only considering the principal loan amount and interest rate, neglecting to factor in other essential costs. These include insurance premiums, registration fees, and maintenance expenses.Misunderstanding The Results

Interpreting the results incorrectly can lead to misguided decisions. Ensure you fully comprehend the breakdown of the calculations to avoid any surprises down the road.Comparing Car Loan Offers

When purchasing a new car, comparing car loan offers is crucial to finding the best financing option. It’s important to analyze multiple loan options and seek professional financial advice.Analyzing Multiple Loan Options

Before committing to a car loan, compare interest rates, loan terms, and total repayment amounts.- Utilize a car loan calculator to estimate monthly payments

- Consider the impact of varying loan durations on your finances

- Look for hidden fees or penalties in the loan agreements

Seeking Professional Financial Advice

Consulting with a financial advisor can provide valuable insights and help you make an informed decision.- Discuss your financial situation and goals with the advisor

- Get recommendations on the most suitable loan options

- Clarify any doubts or concerns about the loan terms

Conclusion: Making An Informed Decision

When considering a car loan in the UK, it’s essential to utilize a car loan calculator to make an informed decision. By entering the loan amount, interest rate, and term, you can accurately assess the monthly payments and overall cost, empowering you to choose the best financing option for your needs.Summarizing Key Points

After using the Car Loan Calculator UK, it’s important to summarize the key points to make an informed decision about your car loan. Here are the key takeaways:- The car loan calculator helps you determine the monthly payment amount and total interest paid over the loan term.

- By inputting the loan amount, interest rate, and loan term, you can get an accurate estimate of your repayment obligations.

- Remember to consider any additional fees or charges that may apply to your loan.

- Comparing different loan options using the calculator can help you find the most suitable car loan for your budget and financial goals.

- Understanding the impact of interest rates on your repayment amount can help you negotiate better terms with lenders.

Next Steps After Calculation

Once you have used the car loan calculator and obtained the results, it’s time to take the next steps towards securing your car loan:- Review the calculated monthly payment and ensure it fits comfortably within your budget.

- Consider your current financial situation and evaluate whether you can afford the monthly payments for the selected loan term.

- Research different lenders and loan options to find the best interest rates and terms for your car loan.

- Compare the total interest paid over the loan term for different loan options to determine the most cost-effective choice.

- Collect all the necessary documentation required by lenders, such as proof of income, identification, and credit history.

- Apply for pre-approval from lenders to get a better idea of the loan amount you can afford.

- Once pre-approved, finalize the loan application process with the chosen lender.

- Read and understand the loan agreement, including all terms and conditions, before signing.

- Ensure you have a clear repayment plan in place to make timely payments and avoid any potential penalties.